The Cash App was created by Square, Inc, and is a peer-to-peer payment service.

Some app highlights:

As of May 2020 Cash App’s services are only available at the US and UK. Cash App is visited by 8.4 Million users every month. Considered one of the hottest payment apps of 2020. Fairly reasonable services fees compared to other platforms (Venmo,PayPal…). Stocks and bitcoin options available (fees are added)

Download The Cash App Now and Get $5

What is Cash App?

Cash App is a peer-to-peer money transfer service developed by Square Inc. that allows users to send and receive money. This service can help you send utility payments to your roommates, pay friends back for coffee, split the cost of a trip or any other money-sending task you want to accomplish with other Cash App users. Cash App also functions similarly to a bank account, giving users a debit card — called a “Cash Card” — that allows them to make purchases using the funds in their Cash App account. The app also allows users to invest their money in stocks and buy and sell bitcoin.

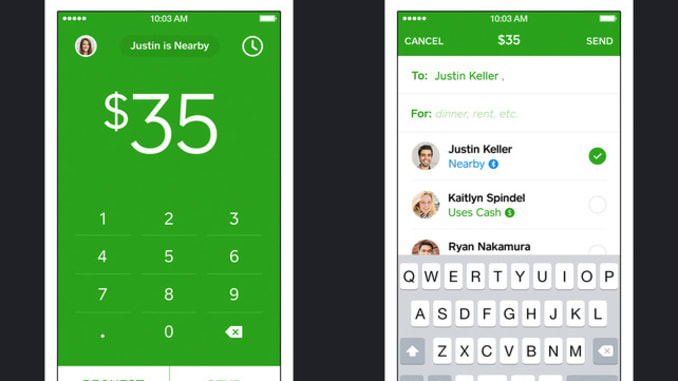

How do you send and receive money with Cash App?

Start by downloading Cash App on your smartphone. The app will walk you through enrollment, where you’ll create a user account and link at least one bank account. You’ll be able to use that bank account to send money to other Cash App users as well as to transfer money from your Cash App account into your bank account. This is similar to services like Venmo and PayPal, which also allow you to link a bank account to send money; you can also hold any received funds in the app until you’re ready to withdraw them.

Start sending payments with Cash App in a few easy steps:

1.Complete the proper registering process and verify your account.

2. Open your Cash App mobile app on the device.

3. Enter the amount you want to send.

4. Click “Pay.”

5. Enter the email address, phone number or (“$Cashtag” – A person’s username in the app).

6. Enter why you are sending the payment for.

7. Tap “Pay.” – Done!

Benefits of Cash App

No fees on basic services. Cash App Don’t Charge Any Monthly Fees, Fees To Send Or Receive Money On The App, Inactivity Fees Or Foreign Transaction Fees

Comes with an optional free debit card. The “Cash Card” allows users to make transactions and withdraw the money that they have in their Cash App account. The card is issued by Sutton Bank and is unique to a user’s Cash App account. It isn’t connected to a personal bank account or another debit card.

Free ATM withdrawals if you set up direct deposit. If Not, The Fee Is $2 To Use An ATM With A Cash Card.

“Cash boosts” help you save money when using the debit card. Users Who Own The Cash Card Can Choose A Certain “Boost” On Their Account That Allows Them To Save Money On A Purchase With A Vendor Or Supplier Of Services (For Example, 15% Off An Order With DoorDash). Only 1 Boost Is Allowed To Be Active, But You Can Switch Up Boosts As Often As You Wish.

You receive a cash bonus for friends who join using your referral code. If you send a referral code to your friends and they sign up for Cash App using your link, then both you and they receive a cash bonus. You’ll receive $5 per friend who signs up, and they’ll receive $10 for signing up.

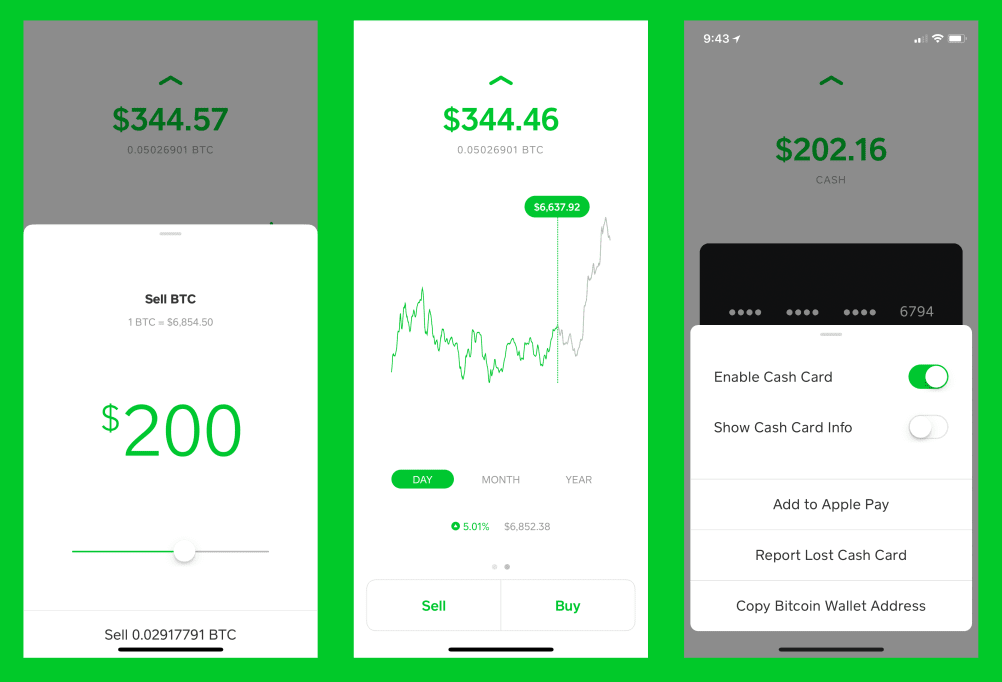

The ability to invest. The Cash App Allows To Buy Stocks In Certain Companies With As Little Or As Much Money As They Feel Comfortable To Invest. Stocks Can Be Bought With The Funds In Your Cash App Account. If You Don’t Have Enough Money In The App, Then The Remaining Amount Will Be Charged From Your Linked Bank Account.

Buying Bitcoin But There’s Fees. Cash App users can buy and sell bitcoin, but Cash App will charge two kinds of fees: a service fee for each transaction and, depending on market activity, an additional fee determined by price volatility across U.S. exchanges.

Things to consider about Cash App

There is a fee to use a credit card. Cash App Charges 3% Of The Transaction To Send Money Via Linked Credit Card. Compared With Other Money Transfer Apps; Venmo, For Example This Is A Reasonable Fee. Other Companies Like The Mentioned Venom Also Charges 3% To Send Money With A Linked Credit Card..

There are spending limits on the Cash Card. The maximum that can be spent on your Cash Card is $1,000 per day and per week. The maximum that can be spent per month is $1,250.

There are withdrawal limits on the Cash Card. A Maximum Amount That Can Be Withdrawn With ATM Or Store Register Cash-Back Transaction Is $250 Per Transaction, $250 Per Day, $1,000 Per Week And $1,250 Per Month.

Your funds aren’t FDIC-insured. Cash App’s functionality may walk and talk a bit like a bank, but there is a clear distinction between the app and a bona fide, bank-chartered financial institution. Despite the fact that the Cash Card is issued by FDIC-insured Sutton Bank, customers’ funds in Cash App are never transferred or held with Sutton Bank and therefore don’t receive FDIC insurance.

Other features:

Account Verification – It Is Super- Easy To Set Up Your Cash App Account. Just Enter The Requested Information, Get A Code Sent To You (Mail Or Phone Verification) And Confirm The Email Address Or Phone Number. Then, You Can Choose Whether It’s Going To Be A Personal Or Business Account. You’re Also Going To Have To Link Your Bank Account So That You Can Send/Receive Money.

4 Ways To Send And Receive Money With Square Cash – You Can Go To The Cash App Website, Use The Cash App, Ask Siri To Send Money For You, Or Use The iMessage Integration For Apple Products.

Payment Notifications – When You Send Money, The Recipient Gets A Text Or Email To Let Them Know.

Payment Methods Linked To Cash App Accounts – A Cash Card (Free) To Spend From The Cash Account, Or You Can Link To Your Debit Card Or Bank Account So The Money Can Be Deposited Into It.

You’ve Also Got 2 Speeds When It Comes To Deposit Money: Instant And Standard. The Standard Deposit Can Take Three Days Before Posting To The Account. Plus, It Can Take Longer If It’s The Weekend Or A National Holiday Where Banks Are Closed.

Instant Option – The Money Is Deposited Immediately But, You’re Also Charged A Fee Of 1.5% Of The Full Deposit Amount To Do This.

Download The Cash App Now and Get $5