Save money with the right card

You are probably familiar with how burdensome credit card debt can be. However, you’ll be relieved to know that it is possible to pay down your debt and/or interest with relatively lesser payments in a shorter period. Balance transfer cards offer longer zero percent interest and that’s why it might a good option to transfer your debt to these special cards. Where as a standard credit card comes with interest rates applicable on balances that are carried over month to month, a balance transfer card will give you some breathing space to pay down debts before interest starts to accumulate.

Take advantage of special introductory 0% APRs

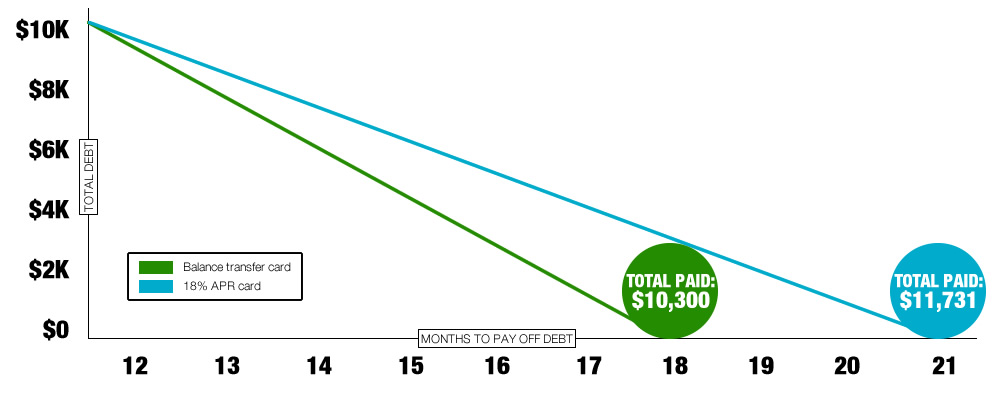

Interest rates play a crucial role in your efforts to pay down debt. For perspective, compare the amount you would have to pay if there is an 18% APR on a debt of $10,000 versus using a balance transfer card at 0% interest. In spite of paying $300 in transfer fees, you could still save approximately $1,431 by paying down debt with this card. What’s more, you can even save on transfer fees by applying for a card on which transfer fee is not applicable. There will be various factors such as credit scores used to determine whether you qualify for transfer savings.

Balances Owed On a 18% APR Card Then Transferred to Zero Percent Card Can Save You Over A Thousand Dollars.

On $10,000 Debt: Save $1,431

On $8,000 Debt: Save $1,143

On $5,000 Debt: Save $715

Here are some quick tips for choosing the right card for you:

Know the fees

Make sure you factor in the balance transfer fee (typically 3% to 5%) when choosing a card.

Avoid paying interest

To get the most savings, aim to pay off your debt before interest kicks in.

If you know your credit score is not as excellent to qualify for the cards below, we have other options with great benefits as well:

Here are some great options for you to start saving money today!

For Excellent Credit: Wells Fargo Platinum Visa® Card

The Wells Fargo Platinum Visa card may be the best balance transfer option most suited for your needs to pay off debts on your credit card. It is a reasonable choice that comes with an 18-month intro period of 0 percent – which is very competitive. Since Wells Fargo is aware that there is no standard rewards package provided with this card, cell phone insurance is offered as an alternative. If the card is used to make phone bill payments, cardholders can get their phones insured against theft and damage worth a maximum of $600. This card comes with several similar protection-based benefits which make it stand apart from the rest.

For Excellent Credit: HSBC Gold Mastercard® credit card

HSBC Gold Mastercard® credit card is the perfect card to save a ton on interest, with zero percent APR for a very competitive amount of months as well zero percent on balance transfers with no penalty APR. Additional benefits include zero annual fee and also a late fee waiver just in case if you are unable to pay on time. See terms for official rules.

For Excellent Credit: Capital One® Quicksilver® Cash Rewards Credit Card

Capital One® Quicksilver® Cash Rewards credit card is the perfect card to save a ton on interest, with zero percent APR for a very competitive amount of months as well zero percent on balance transfers with no penalty APR. Also, in addition get a one-time $150 cash bonus offer after you spend $500 within 3 months of opening account.

Advertiser Disclosure: Insider Money Secrets has partnered with CardRatings for our coverage of credit card products. Insider Money Secrets and CardRatings may receive a commission from card issuers.